Tax Bracket Tables Vs Percentage Method Table Which to Use

Be sure to reduce wages by the amount of total withholding allowances in Table 5 before using the per-centage method tables pages 4344. Employers Withholding Worksheet for Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later Keepfor Your Records able 4 Step 1.

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More The Wealthadvisor

These are the rates for taxes due.

. For Single Filers Taxable Income. Be sure to reduce wages by the amount of total withholding allowances in Table 5 before using the percentage method tables. Your 2021 Tax Bracket to See Whats Been Adjusted.

If you cant use the Wage Bracket Method tables because taxable wages exceed the amount from the last bracket of the tablebased on filing status and pay period use the Percentage Method tables in section 4. Ad Learn More About Tax Brackets And Federal Income Tax Rates And Start Filing w TurboTax. If you dont want to use the wage bracket tables to.

12 bracket -13675. Minus minimum amount of 10 bracket -11900. The below annual payroll table is the method used in HRS for ALL employees Table 7 Annual Payroll Period.

The simplest method for calculating federal income tax is the wage- bracket method. Heres a breakdown of the calculation. Up to 24 cash back The most popular methods are the wage - bracket method and the percentage method.

Discover Helpful Information and Resources on Taxes From AARP. Wage ranges based on the percentage method of annual wages for a single individual after subtracting withholding allowances for wages paid in 2018 are as follows. Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2019 or Earlier.

The Wage Bracket Method tables cover only up to approximately 100000 in annual wages. Use the Wage Bracket Method tables because taxable wages exceed the amount from the last bracket of the table based on filing status and pay period use the Percentage Method tables in section 4. If you cannot use the wage bracket tables because wa-ges exceed the amount shown in the last bracket of the ta-ble use the percentage method of withholding described below.

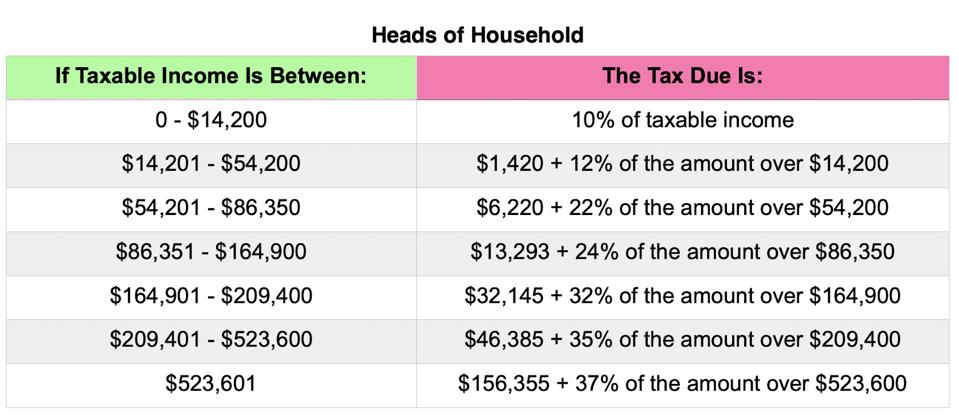

Determine the net taxable wages as shown on the Percentage Method Tables for Income Tax Withholding. For Married Individuals Filing Joint Returns Taxable Income. For Heads of Households Taxable Income.

Per 2018 Circular Es percentage method table page 46 this employee would be taxed on wages over 509 at 12 percent plus 3670. Refer to Percentage Method below. 10 12 22 24 32 35 and 37.

Ad Compare Your 2022 Tax Bracket vs. Your bracket depends on your taxable income and filing status. These Wage Bracket Method tables cover a limited amount of annual wages generally less than 100000.

138080 509 87180 x 12 percent 3670 biweekly tax withholding of 14132. The 000 bracket applies to wages up to 3700 The 100 bracket starts when wages exceed 3700 The 120 bracket starts when wages exceed 13225 The 220 bracket starts when wages exceed. 2021 Tax Brackets for Single Filers Married Couples Filing Jointly and Heads of Households.

See 2020 Publication 15-T. Find the proper wage- bracket table based on the employers. Percentage Method Tables for Automated Payroll Systems and Withholding on Periodic Payments of Pensions and Annuities.

To calculate withholding you must know taxable wages pay frequency marital status and withholding allowances. Be Prepared When You Start Filing With TurboTax. If you cant use the wage bracket tables because wages exceed the amount shown in the last bracket of the table use the percentage method of withholding described below.

There are seven federal tax brackets for the 2021 tax year. Plan Ahead For This Years Tax Return. If you cant use the Wage Bracket Method tables because taxable wages exceed the amount from the last bracket of the table based on filing status and pay period use the Percentage Method tables in section 4.

Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later. Amount over bracket. For example a taxpayer who earns 50000 in 2021 and files as single does not pay a tax rate of 22 on all taxable.

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Income Tax Tables In The Philippines 2022 Pinoy Money Talk

Pin On Elementary Resources K 6

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

Who Pays U S Income Tax And How Much Pew Research Center

Excel Formula Income Tax Bracket Calculation Exceljet

Pin On Computersciencehomework

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

2022 Income Tax Withholding Tables Changes Examples

Traditional And Modern Classification Of Accounts An Explanation Of Classification Of Accounts With The Help Of Example Accounting Study Skills Classification

Personal Income Tax Brackets Ontario 2020 Md Tax

New Microsoft Productivity Video Posted By Youaccel Media On Youaccel Online Student Job Seeker Excel

Who Pays U S Income Tax And How Much Pew Research Center

Demand Supply Graph Template The Diagram Is Created Using The Line Tools Basic Objects And Arrow Objects You Economics Lessons Teaching Economics Graphing

Comments

Post a Comment